Credit Unions in Wyoming: Comprehensive Banking Solutions and Member Benefits

Credit Unions in Wyoming: Comprehensive Banking Solutions and Member Benefits

Blog Article

Release the Power of Credit Rating Unions for Your Finances

From exclusive advantages to an extra individualized technique, credit unions supply a special financial landscape that can boost your economic standing. Check out how credit rating unions can change the method you manage your financial resources and pave the course towards a more safe and secure monetary future.

Advantages of Signing Up With a Cooperative Credit Union

Signing up with a credit history union supplies various advantages for people seeking economic stability and community-oriented financial services. One key advantage is the customized attention and customized monetary remedies credit history unions provide to their participants.

Furthermore, credit scores unions are known for their remarkable customer support, with a strong emphasis on structure long-term partnerships with their members. When handling their finances, this dedication to customized solution means that members can anticipate a higher level of care and support. Furthermore, cooperative credit union often provide monetary education programs and resources to aid participants improve their monetary proficiency and make educated decisions about their cash.

Conserving Cash With Cooperative Credit Union

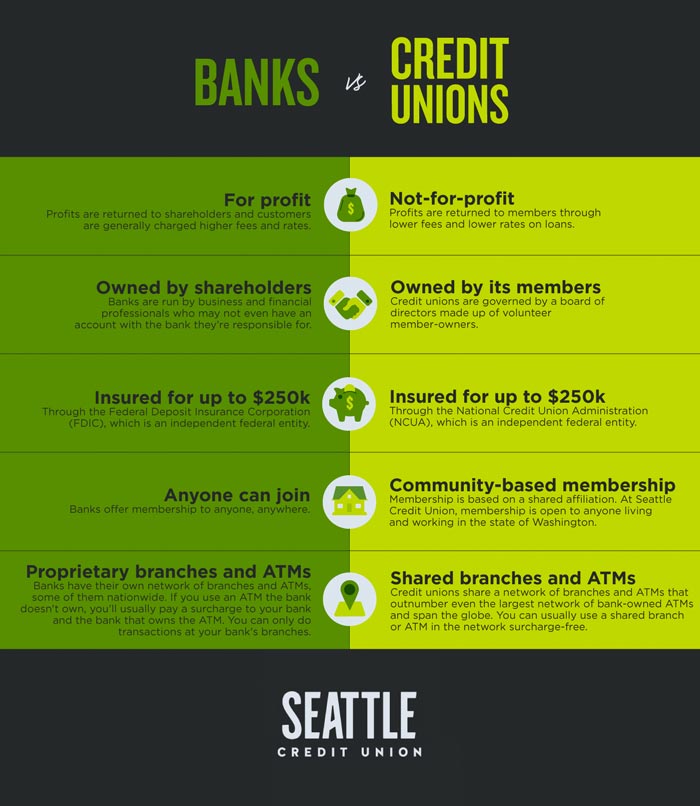

Cooperative credit union offer affordable monetary remedies that can help individuals save money and accomplish their monetary objectives. Among the key means cooperative credit union help members in saving money is with greater interest rates on savings accounts compared to standard financial institutions. By earning more on their deposits, participants can see their financial savings expand quicker gradually. In addition, credit history unions frequently have lower charges and account minimums, making it much easier for members to maintain even more of their hard-earned money.

Unlike huge financial institutions, credit history unions are member-owned and concentrate on the well-being of their participants. Credit scores unions usually provide economic education resources, such as workshops or online devices, to aid members make educated decisions and enhance their conserving practices.

Loaning Wisely From Lending Institution

When considering financial choices, individuals can take advantage of the loaning opportunities provided by lending institution to access cost effective and customized car loan products. Cooperative credit union are not-for-profit economic establishments that prioritize their participants' monetary wellness, usually supplying reduced rates of interest and costs contrasted to typical financial institutions. By borrowing intelligently from lending institution, individuals can take advantage of individualized solutions and a much more community-oriented technique to loaning.

One of the vital benefits of loaning from credit scores unions is the potential for reduced rates of interest on fundings - Wyoming Credit Union. Lending institution are understood for providing competitive prices on various kinds of financings, consisting of personal lendings, auto loans, and home mortgages. This can lead to significant price financial savings over the life of the finance compared to obtaining from traditional banks

In addition, credit rating unions are extra versatile in their lending standards and may be extra going to deal with members that have less-than-perfect credit scores. This can provide people with the opportunity to access the funds they require while also enhancing their credit rating with time. By borrowing intelligently from credit report unions, people can accomplish their economic goals while developing a favorable connection with a relied on economic partner.

Preparation for the Future With Lending Institution

To protect a secure financial future, people can strategically straighten their lasting goals with the thorough planning services used by credit rating unions. Lending institution are not practically lendings and cost savings; they additionally provide important monetary planning help to assist participants accomplish their Full Report future ambitions. When preparing for the future with cooperative credit union, participants can take advantage of individualized financial advice, retired life preparation, investment guidance, and estate preparation solutions.

One trick benefit of making use of lending institution for future planning is the personalized approach they supply. Unlike typical banks, cooperative credit union typically take the time to recognize their participants' one-of-a-kind financial circumstances and customize their services to satisfy individual demands. This tailored touch can make a considerable difference in aiding participants reach their long-term economic objectives.

In addition, lending institution usually prioritize their members' economic wellness over earnings, making them a trusted partner in preparing for the future. By leveraging the know-how of lending institution professionals, participants can create a strong monetary roadmap that this post straightens with their desires and sets them on a course towards lasting monetary success.

Achieving Financial Success With Cooperative Credit Union

Leveraging the financial proficiency and member-focused strategy of lending institution can lead the way for people to achieve long-term financial success. Credit unions, as not-for-profit monetary cooperatives, focus on the economic health of their members over all else - Hybrid Line of Credit. By coming to be a participant of a credit scores union, people acquire accessibility to a series of financial products and services tailored to satisfy their details needs

One essential method cooperative credit union aid participants achieve financial success is through providing affordable rates of interest on interest-bearing accounts, financings, and bank card. These positive prices can bring about substantial financial savings over time compared to traditional banks. Additionally, credit score unions often have reduced charges and more individualized client service, promoting a supportive environment for members to make audio economic choices.

Furthermore, credit report unions commonly use monetary education resources and counseling to aid participants improve their financial proficiency and make educated selections. By capitalizing on these services, people can create strong finance abilities and work towards achieving their lasting economic goals. Ultimately, partnering with a lending institution can empower people to take control of their finances and establish themselves up for a safe financial future.

Final Thought

Finally, the power of lending institution hinges on their capacity to offer personalized focus, tailored economic services, and member-owned cooperatives that focus on community demands. By joining a lending institution, people can take advantage of reduced fees, affordable rate of interest, and remarkable customer support, causing saving money, obtaining carefully, intending for the future, and achieving economic success. Embracing the special advantages of cooperative credit union can assist people protect their Discover More Here economic future and improve their general economic health.

Credit history unions are not-for-profit financial establishments that prioritize their participants' monetary health, usually using lower interest prices and charges compared to typical banks.In addition, credit unions are a lot more adaptable in their financing criteria and might be more eager to work with participants who have less-than-perfect credit scores.One key method debt unions aid participants accomplish economic success is with supplying competitive rate of interest rates on cost savings accounts, car loans, and credit score cards.In addition, credit history unions usually offer monetary education resources and counseling to help members boost their financial literacy and make notified options.

Report this page